Get your business ready for the upcoming GST rate change in Singapore

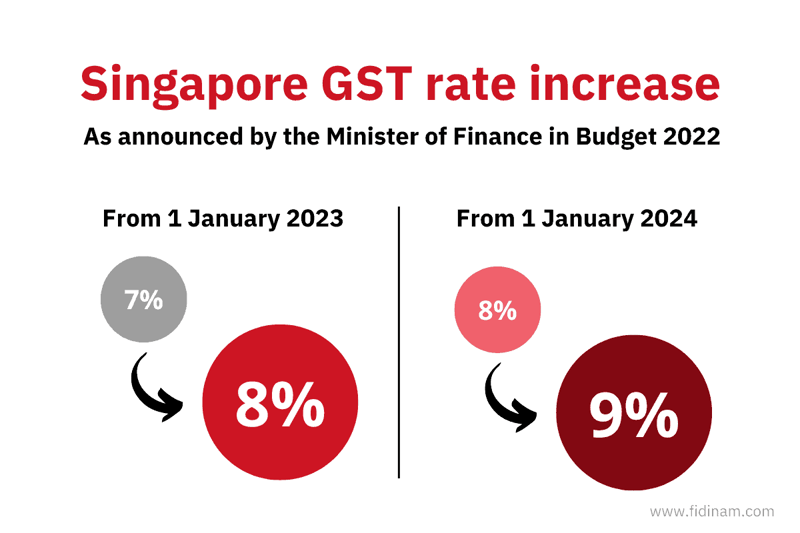

From January 2023, some changes to the GST rate will enter into force in Singapore. Businesses should be aware of the new policies to better exploit the opportunities arising from tax on goods and services.

In particular, the major change will be the increase of the standard rate of 7% to 8%, applicable from 1 January to all businesses currently registered under GST.

GST rate update in your systems

Companies charging GST should be ready and integrate the changes within their accounting and invoicing systems, and retail management systems, along with updates to the cash register and receipting systems for POS billing (point-of-sale).

The process might require much time and effort. Non-compliance may result in penalties from the authorities; hence it is advisable to start the conversion as soon as possible.

From the technical side, help may be provided by the support division of related software vendors

.

New price displays

Starting from 1 January 2023, all price information, including tags, lists and advertisements, must show GST-inclusive prices. This also applies to prices that are quoted, both in written and verbal form.

In this way, the public is better informed and aware of the final cost of goods and services they are requesting.

In the occasion that a business is unable to change the price overnight, they may display two prices:

- Prices inclusive of GST at 7% applicable before 1 January 2023.

- Prices inclusive of GST at 8% with effect from 1 January 2023.

Apply the correct GST rate to your supplies

As a general rule, the reference date for correct pricing is the time of supply. GST should be charged at the prevailing rate based on the time of supply rules.

If the time of supply is triggered before 1 January 2023, GST should be charged at 7%. If the time of supply is identifiable on or after 1 January 2023, the rate of 8% must be applied.

If the time of supply intersects the date of the GST rate change, transitional rules exist to determine which rate must be applied.

For example, if the supplier issues the invoice before 1 January 2023 and both full payment and delivery are received on or after the same date, GST should be accounted for at the new rate of 8%. The rate applies even though the invoice has been issued before the change date.

Also, in case of services performed before 1 January 2023, with invoices and payment happening after the same date, the rate to be applied is under the discretion of the business (either 7% or 8%).

For additional information on transitional rules, you may refer to the e-Tax guide released by IRAS at the following link: “2023 GST Rate Change: A Guide for GST-registered Businesses".

- Fidinam